Legal forms, registration, and associations: Basics for founders

In this module, you will gain a clear overview of the most important legal and organizational steps on your way to founding a company. We start with the legal forms and show you how your choice can affect liability, financing, and team structure. You will then learn how to register your company and what documents you need. We will also introduce you to the most important associations and chambers that founders automatically come into contact with—and explain what role they play for your startup. Finally, we will give you an overview of further information portals that will provide you with reliable support even after the module is over.

The module is aimed at founders who are looking for a practical introduction to the formalities and want to understand the legal basics without getting lost in technical jargon.

⚠️Disclaimer⚠️

The information provided in this document is intended solely for general orientation for founders and startups. It does not constitute legal or tax advice and cannot replace an individual assessment by qualified professionals.

For binding and well-founded decisions regarding legal structures, tax matters, or legal frameworks, you should consult exclusively with certified tax advisors or lawyers.

Why the legal form matters for your startup

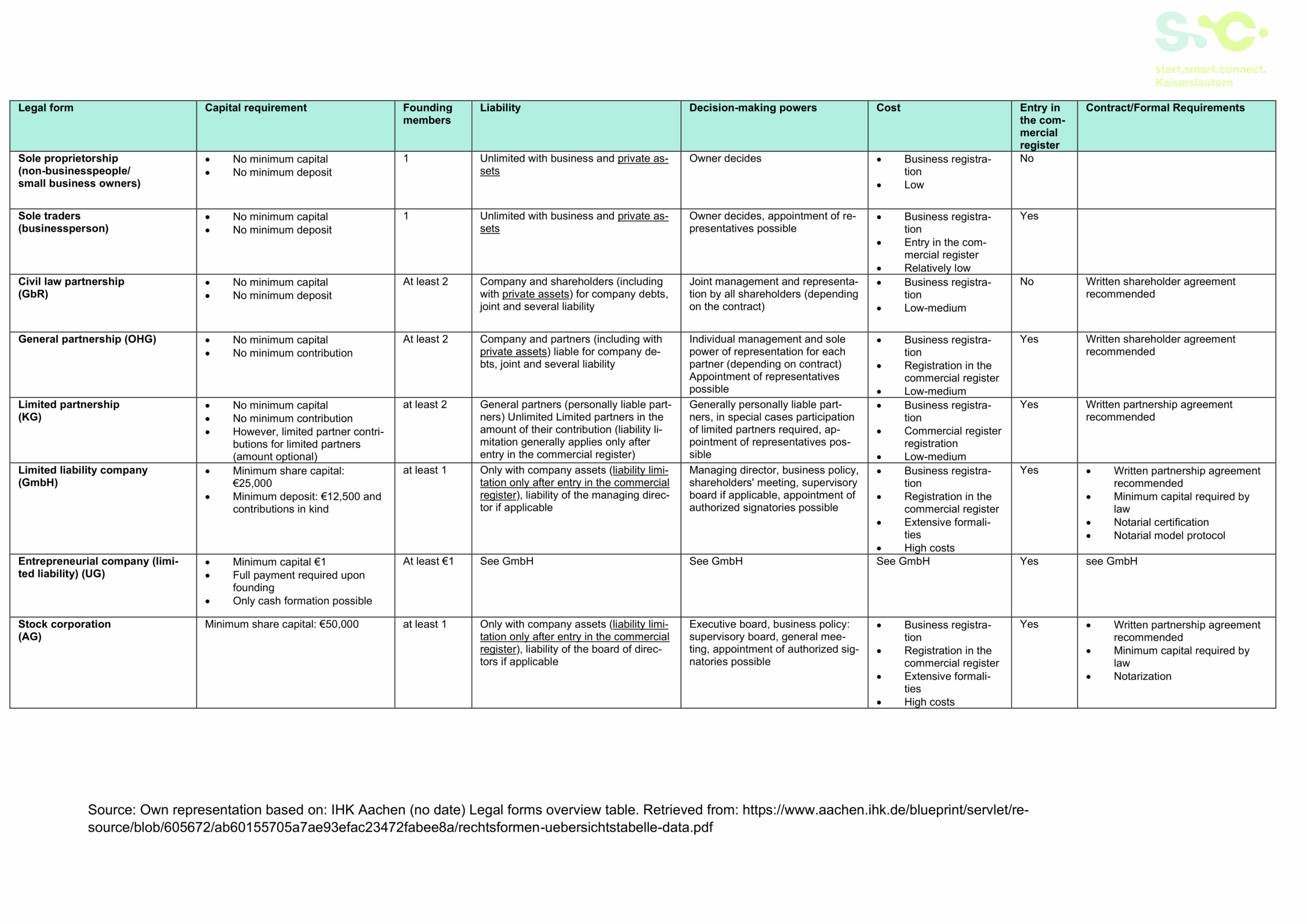

When you start a company, sooner or later you’ll have to face the question: Which legal form should my business take? A legal form is essentially the “legal framework” under which your startup operates externally. It determines how your company is organized, who is responsible for what, and how profits or losses are distributed. Sounds like dry legal theory? Maybe – but choosing the right legal form is a decision that can significantly shape your journey as a founder.

Why? Because the legal form has direct impacts on your future decisions and opportunities:

- Liability: Whether you are personally liable with your private assets or whether the risk remains limited to the company.

- Financing: Whether investors can join or whether you initially rely solely on your own funds.

- Team organization: Whether all founders decide equally or clear roles and voting rights are defined.

- Eligibility for funding: Some funding programs or contracts require a specific legal form, such as a GmbH (limited liability company).

- Partnerships: Industry partners and universities often value a stable, professional legal structure.

Especially in the 6G field, these factors play a major role. Many startups in this area emerge from research projects where patents, intellectual property, or university involvement are important. For discussions with industry partners as well, appearing as a GmbH or UG (entrepreneurial company) sends a strong signal – it shows professionalism and builds trust.

The good news: You don’t need to know every detail at the beginning. What matters is that you understand why this decision is so relevant and what direction it sets for your startup. The legal form is not a hurdle but a tool that opens doors – to funding, investors, partners, and to a clear structure within your team.

So: Don’t see the choice of legal form as a tedious obligation, but as a strategic step for the future of your startup.

Below you will find an overview of the legal forms in Germany.

Related videos:

Serlo Education. (2019, 31. Mai). Unternehmensformen einfach erklärt – Rechtsformen: AG, GmbH, UG & Co. [Video]. YouTube. https://www.youtube.com/watch?v=uFfsZA3wnWE

Select legal form

Registration is the starting point for your business activities: only then can you issue invoices, conclude contracts, and build your business professionally. It is therefore the basis for turning your idea into a real company.

Arrange a notary appointment

Notary Appointments – What? Why? What for? Costs?

A notary is a person authorized to certify legal transactions, facts, evidence, and signatures. They also handle the safekeeping of financial deposits. When founding a company, the notary certifies the articles of association or shareholder agreement and registers the company with the commercial register once the required share capital has been deposited.

Preparing for the Appointment

The shareholder agreement should be finalized before scheduling an appointment. It’s advisable to send the documents to the notary in advance so they can review them. Most notaries also offer legal advice on contract-related matters.

The agreement must state, among other things, who will serve as the managing director. You should also provide all documents related to the company formation to the notary. In parallel, founders should arrange appointments for opening a bank account and for notarization to keep the process on track.

Certification of Contracts and Documents

The notary’s main task is to certify the shareholders’ signatures. This includes the articles of association, the shareholder list, and the incorporation protocol. These documents specify who will be appointed as managing director. These decisions should be made before the notary appointment.

Depositing Capital and Commercial Register Entry

Once the share capital is deposited into the business account, the notary can register the company with the commercial register. Proof of deposit can be provided with a simple deposit slip.

Once all required documents are submitted to the notary, the information is forwarded to the district court. The court checks the documents for completeness, including company name and business purpose. If everything is in order, the entry is usually made within 1–2 weeks. You’ll receive a commercial register number, which must be displayed publicly, e.g., on your company’s website.

Important: The commercial register is public. After registration, you may receive fake invoices from directory services. Do not pay these!

Costs

The costs depend on the company’s share capital, number of shareholders, and any additional services provided by the notary. Costs typically arise for:

- Drafting and certifying the articles of association

- Drafting and certifying the managing director appointment

- Drafting and certifying the commercial register application

- Submitting structured data

- Monitoring the share capital deposit

Additional costs include postage and 19% VAT.

Besides notary fees, there are also court fees for the commercial register entry (e.g. for a GmbH).

The table below gives an overview of estimated costs. Please note that actual costs may vary from notary to notary.

| Fees for GmbH with one shareholder (EUR) | Fees for GmbH with multiple shareholders (EUR) | |

|---|---|---|

| Drafting and notarization of articles of association and director appointment | ~€375.00 | ~€384.00 |

| Drafting shareholder list and verifying company name with the Chamber of Industry and Commerce | ~€96.00 | ~€96.00 |

| Drafting application for the commercial register incl. signature certification | ~€62.50 | ~€62.50 |

| Submitting structured data | ~€37.50 | ~€37.50 |

| Monitoring share capital deposit | ~€62.50 | ~€62.50 |

| Copy and print expenses | ~€10.00 | ~€10.00 |

| Postage and telecom flat fee for company formation and register entry | ~€40.00 | ~€40.00 |

| Court fees | ~€150.00 | ~€150.00 |

| Total | €833.50 | €842.50 |

All notarial costs are subject to 19% VAT.

Sources:

Gründerplattform.de (n.d.): Your notary appointment. Retrieved from: https://gruenderplattform.de/unternehmen-gruenden/notartermin-vereinbaren

Smartlaw.de (2017): GmbH formation – costs and how to save. Retrieved from: https://www.smartlaw.de/rechtsnews/unternehmen-gruenden/gmbh-gruendung-was-sie-kostet-und-wie-sie-dabei-sparen-koennen

Disclaimer:

Despite careful research, we cannot guarantee the accuracy of the information provided. This content does not replace professional advice from the relevant authorities.

Open a business account

Open a Business Bank Account

If you want to start a business, you’ll need a place to manage your finances and future transactions. For this and many other reasons, it’s recommended to open a dedicated business bank account to lay a solid foundation for your venture. Additionally, banks offer extensive advisory and support services.

The market offers a wide range of options with varying conditions—not all of which are suitable for founders. However, we believe a low-maintenance and affordable business current account is part of the basic setup for any entrepreneur or freelancer. It helps manage payments with customers, suppliers, and institutions efficiently and smoothly.

Choose your account based on your business needs

Banking offers can vary widely. Before opening an account, consider what sector you’ll be operating in and what financial transactions matter most to you. You can choose between almost free business accounts at online banks or traditional banks with a physical branch network and ATMs. A key factor is cash handling: if you’re working in sectors like gastronomy, events, or retail, a traditional bank with deposit options may be the better choice.

Pay attention to fees and services

Just like with private banking, there are a few important things to consider. Keep the following questions in mind when researching the right business account:

- What fees apply? For example, transaction fees, cash withdrawals, and deposits.

- Can you get an overdraft facility, and under what conditions?

- Is the fee structure transparent and simple? Are there any extra financial products you don’t need?

- Can you create sub-accounts?

- How long are the stated conditions valid?

Who needs a business account?

For some legal forms, a business account is mandatory. This applies to corporations like GmbH, UG, AG, and limited partnerships (KG). Freelancers and self-employed individuals without special banking needs can decide for themselves. However, separating private and business finances makes things much easier to manage.

Why a business account makes sense

With a separate account, it’s much easier to keep track of your business finances. It helps manage recurring costs like office rent, salaries, social security contributions, tax payments, travel expenses, leasing rates, and loans—all in one place.

Your account statements and transactions should be listed clearly, and you should have both digital and physical access to them.

Requirements and registration

To open a business account, banks require certain documents, including:

- Proof of identity: ID card or passport. Note: If you only have a passport, you’ll also need a registration certificate from your local registration office.

- For non-German nationals: residence permit and documents from the immigration office

- Tax identification number

- Possibly a credit report (Schufa)

- If applicable: business registration certificate

Conclusion: A business account supports you and helps you stay organized

A business bank account supports your core business operations and provides a clear overview of your income and expenses—separate from your personal finances. This saves time and lets you focus on the essentials of your business. It’s not just a convenience but a key strategic tool for managing your company.

Source:

Gründerplattform (n.d.): Open a business account at the start of your venture. Retrieved from: https://gruenderplattform.de/unternehmen-gruenden/geschaeftskonto-eroeffnen

Further reading:

Business account comparisons:

Für-Gründer (n.d.): Business account guide: providers, fees, and services of the best accounts. Retrieved from: https://www.fuer-gruender.de/kapital/fremdkapital/hausbank/geschaeftskonto/

Gruenderkueche.de (2021): Business account comparison 2021: The best options for founders and startups. Retrieved from: https://www.gruenderkueche.de/fachartikel/geschaeftskonto-vergleich-geschaeftskonten-fuer-gruender-und-startups/

Disclaimer:

Despite careful research, we cannot guarantee the accuracy of the information provided here. This content does not replace a professional consultation with a representative of the relevant authority.

Professional associations

Occupational Accident Insurance Providers – Overview

What are occupational accident insurance providers?

Occupational accident insurance providers (Berufsgenossenschaften) are institutions responsible for statutory accident insurance for businesses in the German private sector and their employees. Their primary task is to prevent workplace accidents, occupational diseases, and work-related health risks. If employees suffer a work-related accident or illness, the insurance providers support them with medical, vocational, and social rehabilitation. They also help compensate for financial losses caused by such events. As of 2005, 46.2 million people were insured through commercial and agricultural accident insurance providers in Germany.

Overview of Selected Insurance Providers:

- BG RCI – Raw Materials and Chemical Industry

Kurfuersten-Anlage 62

69115 Heidelberg

Phone: +49 6221 5108-0

www.bgrci.de

Email: info@bgrci.de

(Formed by merging multiple industry-specific providers including mining, chemicals, paper, leather, and sugar industries) - BGHM – Wood and Metal Industry

Isaac-Fulda-Allee 18

55124 Mainz

Free service numbers:

0800 999 0080-0 General inquiries

0800 999 0080-1 Membership and contributions

0800 999 0080-2 Occupational safety

0800 999 0080-3 Medical treatment and rehabilitation

Fax: +49 6131 802-20800

www.bghm.de

Email: servicehotline@bghm.de

(Formed in 2011 from multiple metal and wood industry providers) - BG ETEM – Energy, Textile, Electrical, Media Products

Gustav-Heinemann-Ufer 130

50968 Cologne

Phone: +49 221 3778-0

Emergency hotline: +49 211 30180531

Fax: +49 221 3778-1199

www.bgetem.de

Email: info@bgetem.de

(Formed in 2010 from various industry providers including energy, fine mechanics, textiles, and printing) - BGN – Food and Hospitality Industry

Dynamostraße 7–11

68165 Mannheim

Phone: +49 621 4456-0

Fax: 0800 197755330000

www.bgn.de

Email: info@bgn.de

(Formed in 2011 by merging with the Butchers’ Insurance Provider) - BG BAU – Construction Industry

Hildegardstraße 28–30

10715 Berlin

Phone: +49 30 85781-0

Fax: +49 30 85781-500

www.bgbau.de

Email: info@bgbau.de - BGHW – Trade and Logistics

M 5, 7

68161 Mannheim

Phone: +49 621 183-0

Fax: +49 621 183-5191

www.bghw.de

Email: direktion-mannheim@bghw.de

(Formed by merging providers for retail and wholesale trade) - VBG – Administrative Sectors

Massaquoipassage 1

22305 Hamburg

Phone: +49 40 5146-0

Fax: +49 40 5146-2146

www.vbg.de

Email: kundendialog@vbg.de

(Formed by merging administrative, railway, and glass/ceramic industry providers) - BG Verkehr – Transport, Postal Logistics, Telecommunications

Ottenser Hauptstraße 54

22765 Hamburg

Phone: +49 40 3980-0

Fax: +49 40 3980-1666

www.bg-verkehr.de

Email: info@bg-verkehr.de

(Merged in 2016 from transport and postal/telecom providers)

Tübingen Office:

Europaplatz 2

72072 Tübingen

Phone: +49 7071 933-0

Fax: +49 7071 933-4398

Email: tuebingen@bg-verkehr.de - BGW – Health and Welfare Services

Pappelallee 33/35/37

22089 Hamburg

Phone: +49 40 20207-0

Fax: +49 40 20207-2495

www.bgw-online.de

Email: online-redaktion@bgw-online.de

For further information, visit the German Statutory Accident Insurance portal: DGUV official website

Sources:

German Social Accident Insurance (DGUV) (n.d.): About Us. Retrieved from: https://www.dguv.de/de/wir-ueber-uns/index.jsp

German Social Accident Insurance (DGUV) (n.d.): Occupational accident insurance providers. https://www.dguv.de/de/bg-uk-lv/bgen/index.jsp

Associations

What is the IHK? (in German: Industrie- und Handelskammer)

The Chambers of Industry and Commerce (IHKs) are regionally organized, cross-sector associations of businesses. The IHK network consists of 79 regional chambers across Germany. Their goal is to support member companies, employees, and the local economy to foster growth. They provide a broad range of consulting services, accompany business startups, and offer guidance on legal and tax-related matters.

Overview of IHK Offices in Rhineland-Palatinate and Saarland

Rhineland-Palatinate:

- IHK Service Center Kaiserslautern

Europaallee 14–16 | 67657 Kaiserslautern

Phone: +49 631 41448-0 | Fax: -2704

Email: service.kl@pfalz.ihk24.de

Contact - IHK Service Center Landau

Im Grein 5 | 76829 Landau

Phone: +49 6341 971-2510 | Fax: -2514

Email: service.ld@pfalz.ihk24.de

Contact - IHK Service Center Pirmasens

Adam-Müller-Str. 6 | 66954 Pirmasens

Phone: +49 6331 523-2610 | Fax: -2614

Email: service.ps@pfalz.ihk24.de

Contact - IHK Service Center Ludwigshafen

Ludwigsplatz 2–4 | 67059 Ludwigshafen

Phone: +49 621 5904-0 | Fax: +49 621 5904-1214

Email: service.lu@pfalz.ihk24.de

Contact

Saarland:

- IHK Service Center Saarbrücken

Franz-Josef-Röder-Straße 9 | 66119 Saarbrücken

Email: info@saarland.ihk.de

Contact

Sources:

Information portals

Additional Information Portals for Aspiring Entrepreneurs

In addition to the resources available in the IDEENWALD Pathfinder, there are numerous online portals that provide valuable information about starting a business. Here are some of the best and most important resources on topics relevant to entrepreneurship:

-

- Federal Ministry for Economic Affairs and Energy (BMWi): Start-up Portal

This information and training platform by the BMWi aims to increase the number of new businesses in Germany by offering comprehensive resources. Topics include preparation (legal forms, business plans, financing), business operations (law, contracts, markets, HR, sustainability), checklists, and templates. It is publicly funded and completely free of charge.- GründerZeiten

Part of the BMWi portal, this regularly published info sheet covers topics like starting a business in Germany, insurance, financing, taxes, and more. It’s available for download or by order. - BMWi Start-up E-Learning Program

This online learning tool covers all stages of starting a business—from the initial decision and planning to later business management. It includes articles, checklists, diagrams, and more.

- GründerZeiten

- Gruenderplattform.de

A publicly funded online platform supported by the BMWi that equips founders with essential tools and guidance throughout the entire start-up process—from idea development and planning to financing and company formation. The platform is free of charge. - Für-Gründer.de

This portal covers all aspects of self-employment and business formation—from idea to business registration. It includes a wide range of free and paid tools as well as information on planning, founding, scaling, and useful services. - Gründerszene.de

Gründerszene is a magazine that reports on the start-up ecosystem, new companies, innovations, and business trends. Topics include business, tech, fintech, food, health, careers, and mobility. The site also offers a podcast, job board, and event calendar.

- Federal Ministry for Economic Affairs and Energy (BMWi): Start-up Portal